Student Loans

Great Lakes Credit Union has everything you need to help manage your money and plan for the future.

Money SmartsMarch 5, 2021

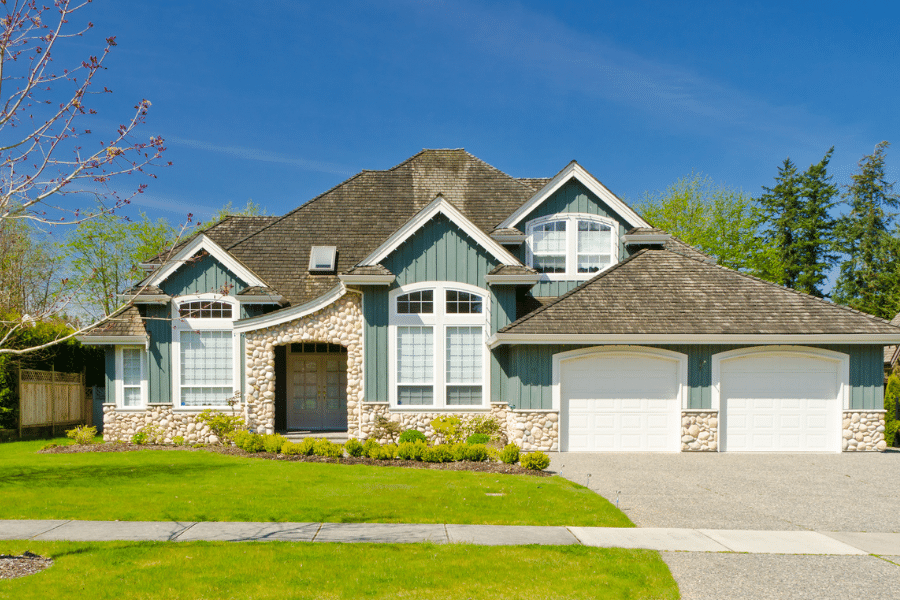

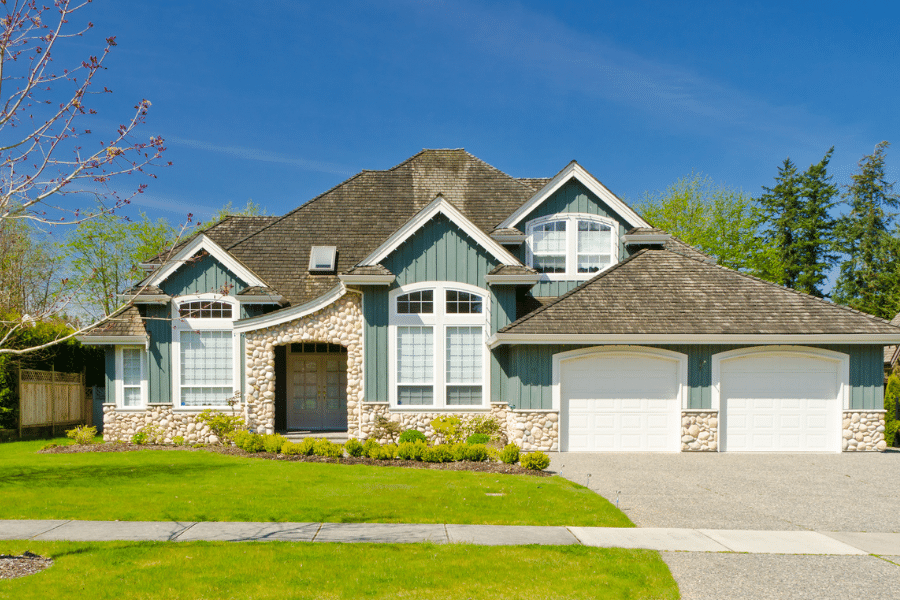

In this post, we will tackle ever-growing property taxes.

In this post, we will tackle ever-growing property taxes.

Let’s cover a few basics first. Property taxes are collected by the county to pay for education, government operations, public libraries, and parks among other items.

They are paid in arrears, so that means in 2021 we are paying the taxes for 2020. These taxes are based on the tax rates for each county. These rates are applied to the assessed value of your property. If you want to lower your tax bill, you need to lower your property’s assessed value.

There are two ways to lower your assessed value. The easiest way is to apply for exemptions. Some of the following exemptions available In Illinois include:

Check with your county to determine the deadlines for applying for these exemptions.

The other way to lower your assessed value is to look for problems with the assessment itself. You can check with your county’s assessor to get a copy of your assessment or wait until you receive your assessment notice or letter in the mail.

You will receive this notice after the periodic assessments have been completed. All properties in Cook County, for example, are assessed every three years.[2]

Your assessment notice will contain information about your property such as; the assessed value, lot size, building size, and exemptions that have been applied. Your tax amount is determined by the factors noted in your assessment notice. So if you have received your notice, the first step is to carefully review it. Are there simple errors such as your property lot size is noted as 2 acres when it is actually .2 of an acre. Are there exemptions that you are entitled to that are not included in your notice?

Possibly you disagree with the assessed value of your property itself. The next step is to determine your county’s procedure and requirements for correcting errors or making other changes. You can either visit your county assessor’s office (if it is open during the pandemic) or check their website. Things to look for include:

This last bullet point is probably the most important one. There are usually set windows of time for filing your appeal. In Cook County, you have 35 calendar days to complete your appeal after you have received your reassessment notice.[3]

Illinois has some of the highest tax rates in the nation,[4] so if you are a homeowner and are looking to save money, appealing your property taxes might be a good option for you.

References

[1] Adapted with permission from Understanding Property Taxes in Illinois PowerPoint by Mohammed, Shamaileh & Tabahi, LLC and Law Offices of Ryan Schaefges, P.C. for presentation at GLCU’s 3/27/21 webinar on appealing your property taxes

[3] www.cookcountyassessor.com/appeals

[4] www.houselogic.com/finances-taxes/taxes/property-tax-appeal